Government Changes to the Use of Red Diesel Jeremy Haulage Ltd

The non‑refundable tax credit for volunteer firefighters and the non‑refundable tax credit for search and rescue volunteers will be increased as of the 2023 taxation year. The credit will increase to $5,000 (from $3,000) and the amount will automatically be indexed each year, starting with 2024.

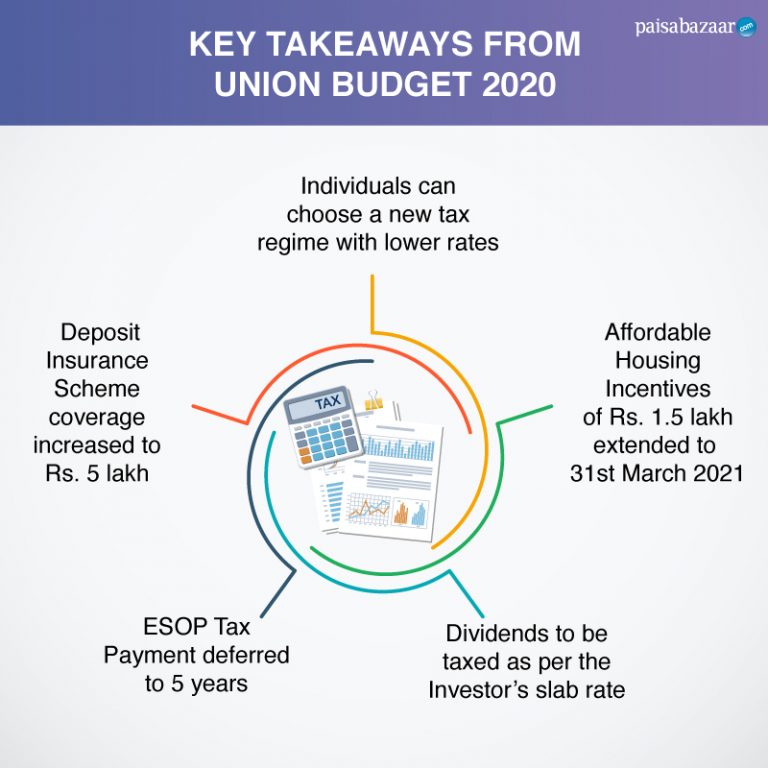

The 2020 budget in a nutshell BusinessTech

16 July 2020. HM Treasury has published a consultation - closing 1 October 2020 - on reforms to the tax treatment of red diesel and other rebated fuels. As Budget 2020, the Government announced that it will remove the entitlement to use red diesel from April 2022, except in agriculture (as well as forestry, horticulture and pisciculture.

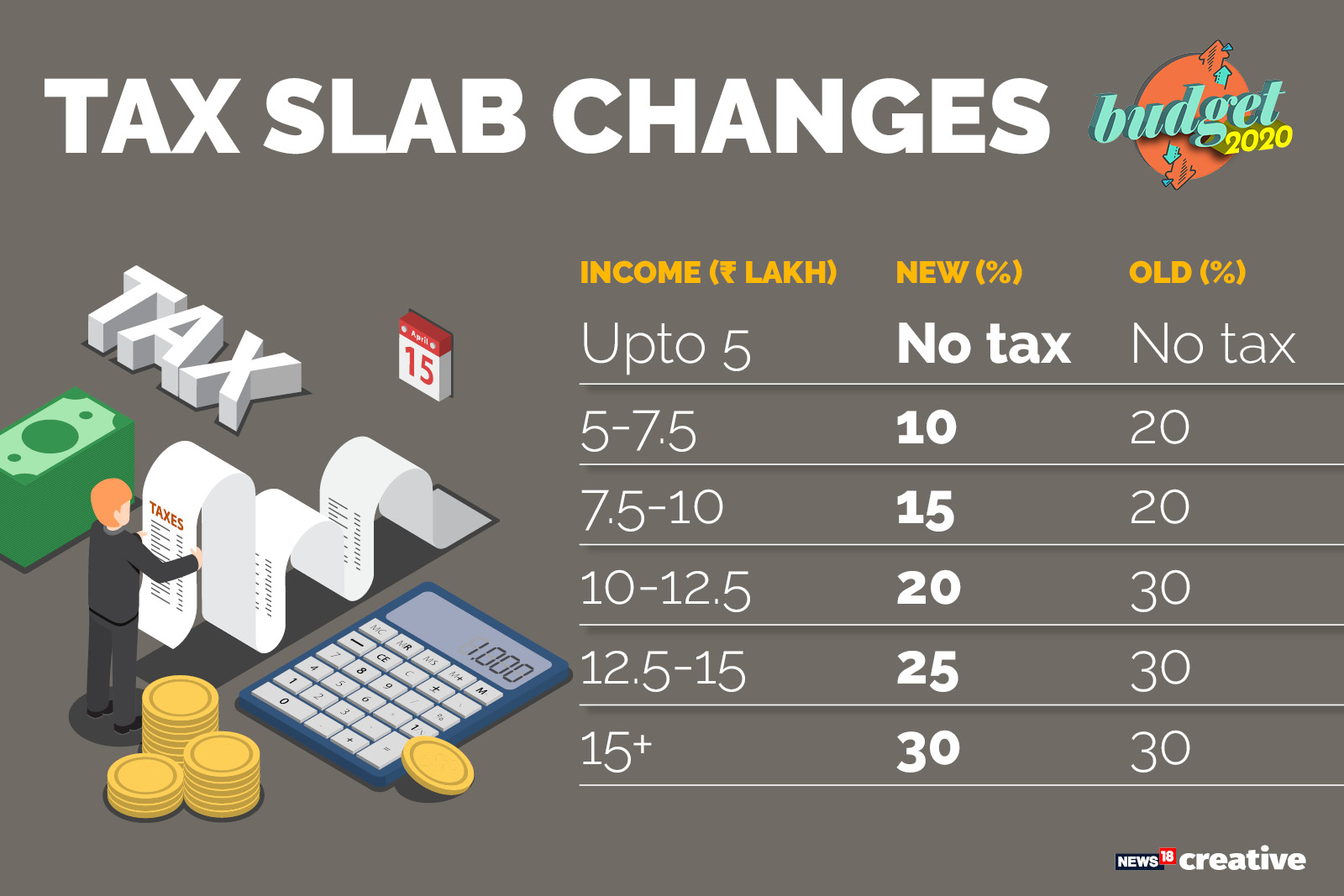

Standard Deduction In New Budget 2020 Standard Deduction 2021

A Treasury spokesperson told letsrecycle.com: "Our changes to red diesel entitlements, set out at Budget 2020, will mean that from April most current users of red diesel in the UK will need to use diesel taxed at the standard fuel duty rate, like motorists, more fairly reflecting the harmful impact of the emissions they produce." Alternatives

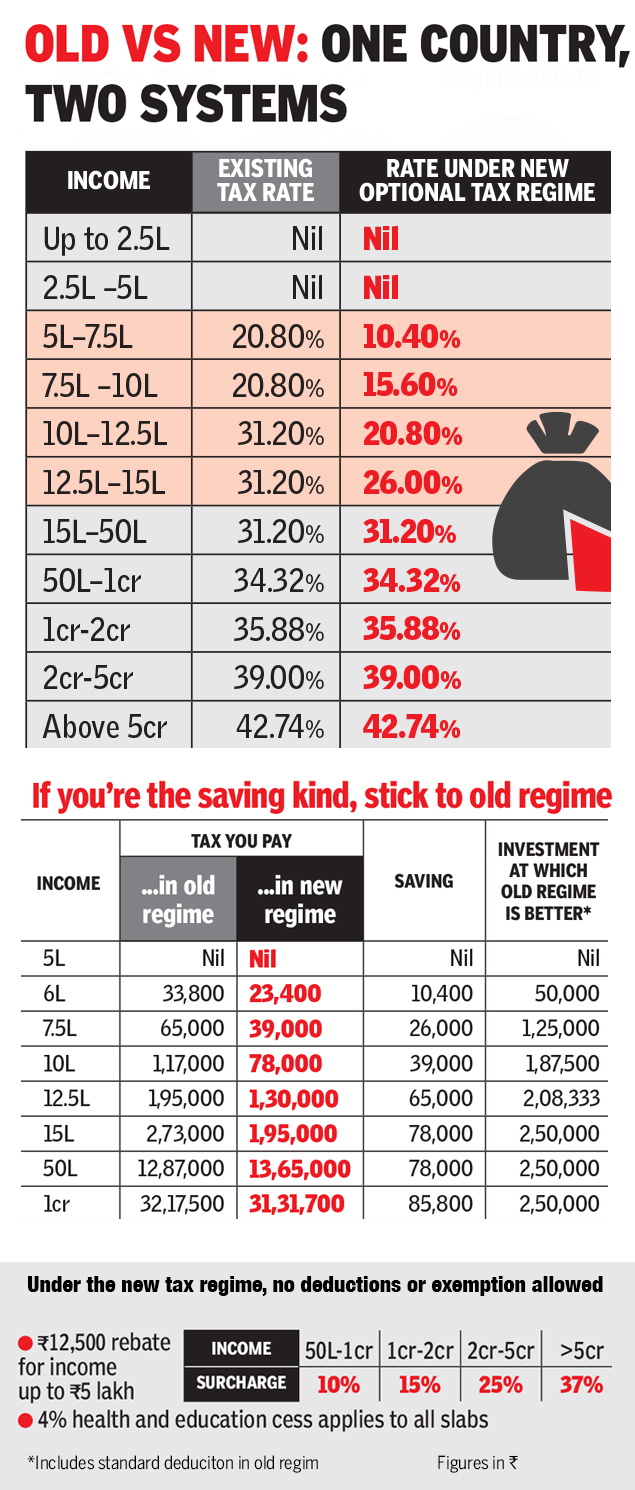

Budget 2020 A 6 point analysis of what the new tax regime means

Budget 2020: from red diesel rebate changes to fuel duty freeze, what the statement means for motorists. Vehicle excise duty - or car tax -remains unchanged for most drivers. However, as part.

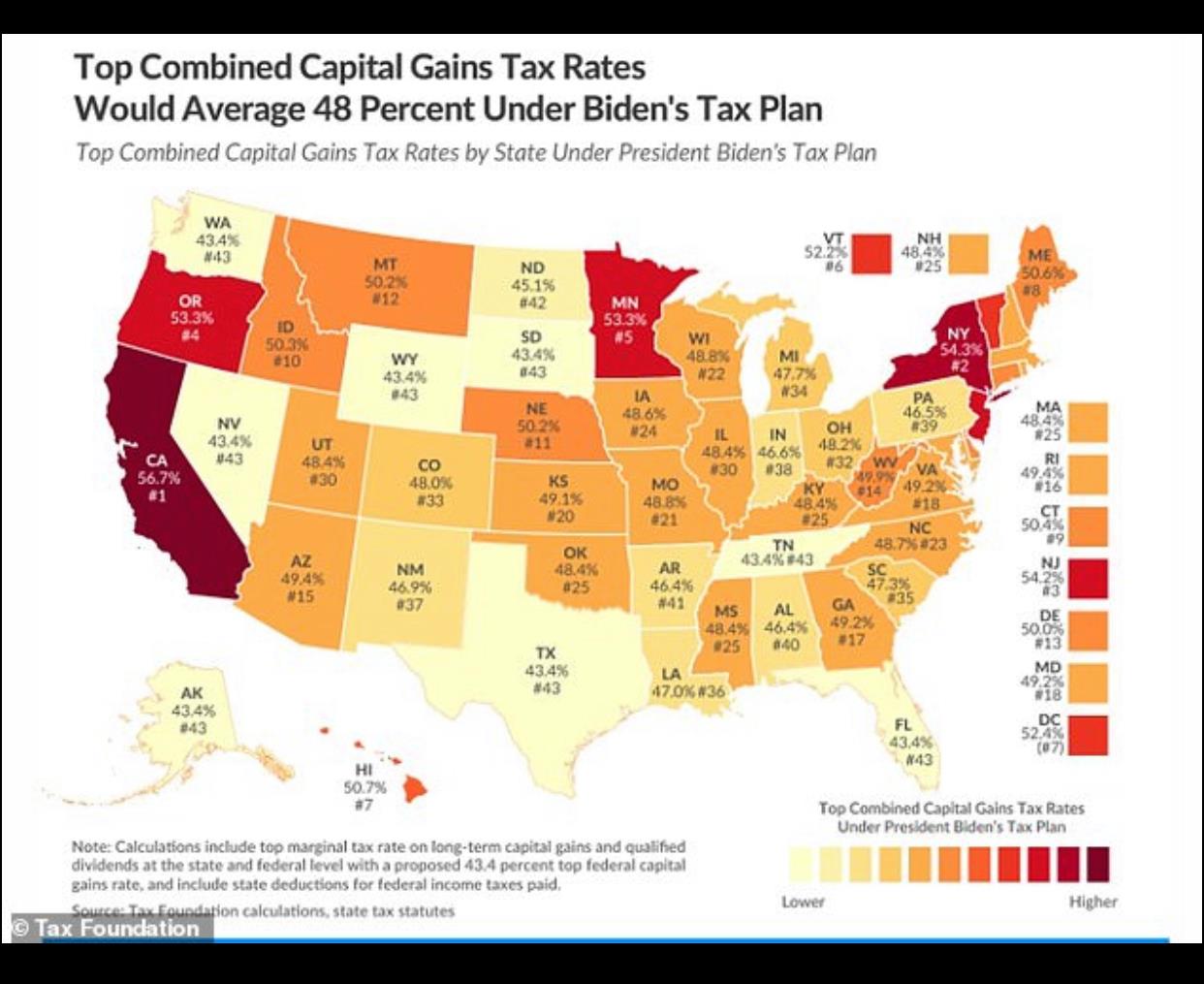

These are the states that updated their 2020 tax filing deadlines

The Chancellor's Budget shows clear signs that the UK government is now moving towards general carbon taxation. As a taste of things to come, government is increase fuel tax on diesel for parts of the construction industry, amongst others, by 400%, from the currently discounted

Red Diesel Tax Changes from April 2022 Sodbury Fuels

Details. This measure introduces legislative changes to restrict entitlement to use red diesel and rebated biofuels for certain uses. You can also read the consultation on reforms to the tax.

Budget 2020 Direct Tax Highlights, Updates & Changes in Personal Tax 2020

At Budget 2020, the government therefore announced that it would remove the entitlement to use red diesel and rebated biodiesel from most sectors from April 2022 to help meet its climate change and air quality targets.. By March 2021 Budget, changes to tax relief for rebated gas oil (red diesel) were confirmed by the Chancellor of the.

.png)

Changes To Red Diesel Taxation 2022 — James D Bilsland Ltd

1.18 Chapter 3 of this consultation provides information on red diesel, including on its current uses and existing tax treatment. It then sets out in more detail the specific changes announced at Budget 2020 to the tax treatment of red diesel, including the g overnment's position on existing fuel duty reliefs and

Changes to red diesel taxation in March 2022

A spokesperson for the HMRC said: "At Budget 2020, the government announced that it would remove the entitlement to use red diesel and rebated biodiesel from most sectors from April 2022 to help.

Changes in NRI TAXATION in BUDGET 2020 by CA Kushal Soni YouTube

The latest budget confirmed some changes to red diesel taxation in response to the consultation it held on the red diesel rebate in 2020. Last year, the government announced that it's removing the entitlement to use red diesel for many sectors from 1 April 2022. The sectors that were said to remain eligible for red diesel use would be:

Union Budget 2020 What’s changed for the Individual Tax Payer?

Posted on 22nd October 2020. At Budget 2020, Chancellor Rishi Sunak announced a change in red diesel eligibility from the 1 st April 2022, which will mean that many sectors will lose permission to use red diesel to power off-road vehicles and equipment. This will pose a huge challenge for many businesses; however, this legislation change is.

Changes to red diesel taxation in March 2022

Deferral of Changes to the Refundable Tax Credit for Resources Announced in the March 20, 2012 Budget Speech . In the March 20, 2012 Budget Speech, the government announced certain changes to the refundable tax credit regime for resources, which were to apply regarding eligible expenses incurred after December 31, 2013.

Budget 2020 Will New Tax Slabs Actually Benefit A Taxpayer

Vehicle excise duty - or car tax -remains unchanged for most drivers. However, as part of a package of measures to make EVs more attractive and less expensive, electric cars will now be exempt.

Red diesel eligibility changes from April 2022 Air Plants Heating

2020 budget changes to tax on rebated biofuels. Neat biodiesel and biodiesel blended with gas oil for non-road use are also currently subject to a rebated duty rate of 11.14ppl. The government announced at Budget 2020 that it would also scrap the application of reduced rates to biofuel from 1 April 2022, like red diesel.

DERV Diesel Fuel Suppliers Nationwide Bulk Diesel Delivery Crown Oil

At Budget 2020, the UK government announced that it would remove the entitlement to use red diesel (gas oil) and rebated biodiesel for many. your eligibility or otherwise for continued purchase and use of rebated fuel .. It is clear that the red diesel tax rebate changes bring a range of challenges for companies that

Budget Summary 2020 Clear House Accountants

Red diesel is entitled to a rebate of 46.81ppl, giving it an effective duty rate of 11.14ppl. At Budget 2020 the government announced that it was removing entitlement to use red diesel from most.